|

|

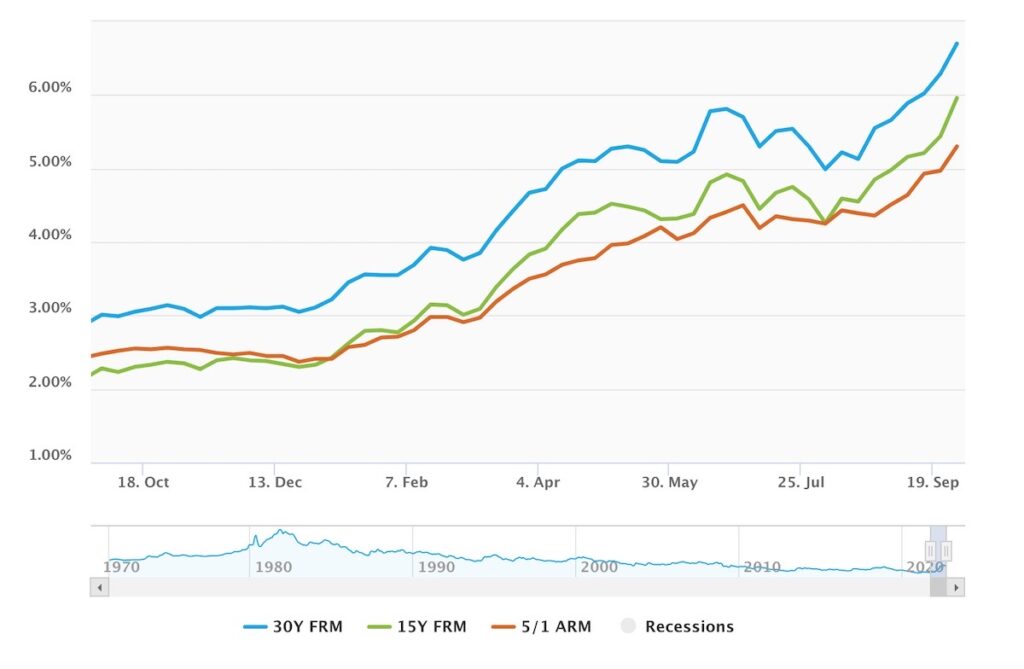

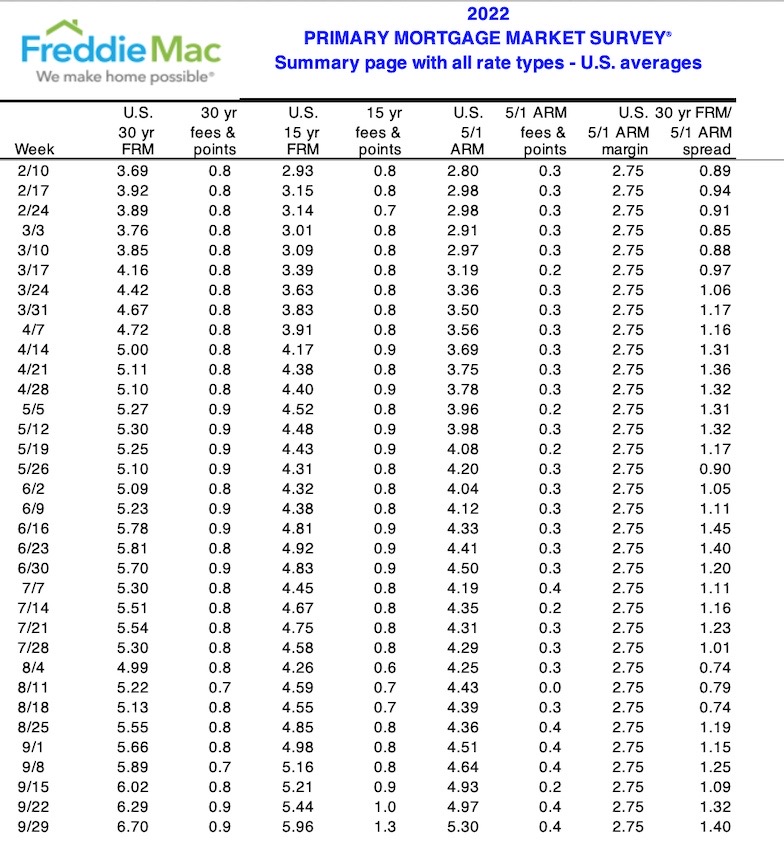

The average mortgage rate on a 30-year fixed mortgage hit 6.7 percent, according to a survey released Thursday by the mortgage giant Freddie Mac.

“The uncertainty and volatility in financial markets is heavily impacting mortgage rates,” a statement read. “Our survey indicates that the range of weekly rate quotes for the 30-year fixed-rate mortgage has more than doubled over the last year.”

The difference can mean an increase of hundreds of dollars a month for someone who locks in mortgages now compared to someone who signed last year. The Wall Street Journal noted that the average rate last week was 6.29 percent, and it is unusual for there to be such an increase in such a brief period of time.

The increase in mortgage rates means more homeowners will be reluctant to sell and renters will reconsider buying in this market. The Mortgage Bankers Association told the paper it expects mortgage originations to fall 48 percent this year due to the drop in refinancing.

CNBC, citing Realtor.com, reported that the average home price in the U.S. is $435,000, which is a 13.1 percent jump from the previous year. Year over year, pending sales were down by 24.2 percent.

Jenica Pivnik, a mortgage loan originator in Calabasas, Calif., told the Trends Journal the she believes there will be a clearer picture on mortgages after the midterms and after the October CPI data is released. She said she was surprised by how quickly the rate jumped.

“We’ve seen weeks of actions condensed in a matter of days,” she said.