|

|

CRYPTO COMMUNITY REACTS TO FTX IMPLOSION

Will investment and further development in legit crypto innovations and efficiencies—and the portfolios of current investors—suffer long term, as a result of the FTX debacle?

Attorney John E. Deaton, founder and host of CryptoLaw, while retweeting info that SBF’s father was an expert in tax shelter law and a Stanford Law professor, commented:

“Anyone who thinks SBF created this shell structure on his own is being naive. Subpoenas and preservation of evidence letters should already be going out to anyone close to SBF.”

Deaton talked possible government connected corruption on Fox Business.

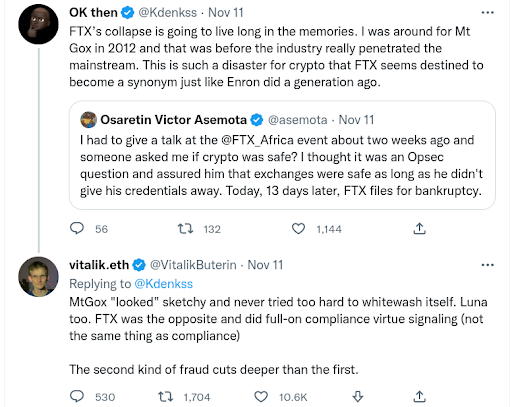

Ethereum founder Vitalik Buterin gave his view that FTX is getting just desserts for its virtue-signaling about regulatory compliance.

In a tweeted reply to another user about FTX, he termed it fraud, saying:

“MtGox ‘looked’ sketchy and never tried too hard to whitewash itself. Luna too. FTX was the opposite and did full-on compliance virtue signaling (not the same thing as compliance)

“The second kind of fraud cuts deeper than the first.”

Elsewhere, Buterin expressed sympathy for SBF the man, but not the CEO:

“SBF the public figure deserves what it’s getting and it’s even healthy to have a good dunking session to reaffirm important community values.

“Sam the human being deserves love, and I hope he has friends and family that can give it to him.”

Besides commenting, Buterin was reportedly making personal business moves based on reading tea leaves. He sold about three thousand ETH, worth almost four million dollars, less than 24 hours after FTX declared bankruptcy, according to theblock.co.

On Coindesk TV, executive director of Blockchain Association, Kristin Smith, said FTX would almost certainly spur Congressional action, as if many pols involved in crypto regulatory sphere had not already played a part in the FTX saga:

“There’s an expectation with crypto customers when they’re keeping their crypto on exchanges that it’s not being taken and lent out and doing something else, like it would be with a bank. This is going to open up a more robust debate around exchange regulation.”

Blockchain Association is the largest U.S. crypto industry advocacy group.

Crypto Holders Beware

At least observers brought up a key point: that keeping crypto on any central exchange or centralized “custodial” service, is a risk that crypto holders may want to closely consider, no matter what happens, going forward.

Paulina Jóśków of Ramp, a crypto payments network that integrates with non-custodial crypto wallets, cautioned:

“Cases like this further emphasize the need for self custody and infrastructure that is built to support decentralization. The near-collapse of FTX also highlights the urgency to hold centralized entities, like [centralized exchanges], accountable for any damage done in such instances.That’s because they’re failing to deliver under its promise to safeguard users’ funds. In [decentralized finance] this problem is solved by code. We have self-custody to make sure users aren’t vulnerable when those in charge are being reckless.”

Many crypto users are not content to buy and hold crypto. They seek to engage in lending and borrowing, as well as treating crypto markets like stock day trading.

As Coindesk noted, some, like Mark Lurie of Shipyard Software, said that users needed to make sure they know the advantages and pitfalls of CeFi and DeFi apps and services.

Lurie argued that because DeFi apps have the ability to be more transparent, with reviewable code and transaction trails, etc., DeFi has the ability to be a solution:

“No doubt, FTX is going to increase regulatory scrutiny of crypto. That’s sad, because the best form of prevention is transparency to the public. Crowdsourcing audits is inherently more scalable than a centralized review, and thus decentralized finance (DeFi) is a long-term answer to this core problem of regulation.

“Hopefully, regulators will avoid conflating DeFi crypto with CeFi crypto so they don’t hamstring the solution to the very problem they are trying to solve.”